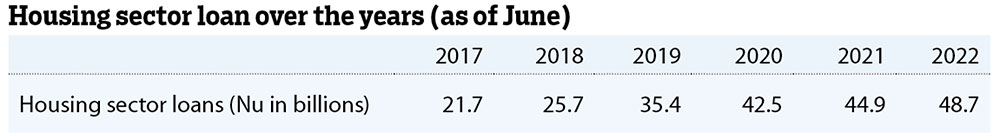

… it has doubled in the past five years

Thukten Zangpo

Housing loan has more than doubled in the past five years and is pumping air into the housing bubble.

As of June last year housing loans stood at Nu 48.66 billion (B), an increase of Nu 26.96B from June 2017, contributing the highest at 26.2 percent of the domestic loan.

Compared to June 2021, the Royal Monetary Authority’s (RMA) annual report states that it saw an increase of Nu 3.75B.

About 79.8 percent of the housing loans were sanctioned for commercial housing and the remaining for homes, indicating that most of the Bhutanese live in rented apartments.

Figures from Bhutan Living Standard Survey 2022 show 37.9 percent of the Bhutanese live in rented houses.

Higher demand for construction with the easing of labour import and imports of raw materials restrictions has led to higher demand for credit, the report stated.

Also, to promote homeownership, housing affordability and availability, the RMA increased the loan repayment tenure for both commercial and residential housing loans up to 30 years excluding the gestation period of three years.

The service and tourism recorded the second-highest share at Nu 47.89B. It contributed to 25.8 percent of the total loans in June last year.

The manufacturing sector grew by 13.4 percent, expanding the loans to Nu 24.8B after being severely affected by the pandemic.

It comprises 13.3 percent of the total loan and includes manufacturing enterprises, mining and quarrying, wood-based products and others (renewable energy, handicrafts and textile production).

The report stated that the government’s priority to promote exports and gradual improvements in the global supply chain contributed to credit growth in the production and manufacturing sectors.

Credit to transport also experienced positive growth of 11.3 percent as of June last year from the same month the previous year.

However, this was mostly translated to the import of passenger vehicles.

At the same time, loans to the agriculture sector, which employs almost 50 percent of the workforce, saw a negative growth of 4.1 percent, amounting to Nu 6.33B in June last year from the same month the previous year.

With the agriculture loan contributing to 3.4 percent of the loans, it reflected a low level of investment in the sector.

The report stated that the government-initiated intervention such as the promotion of cottage and small industry, organic flagship programmes and branding of local products to address the supply side constraints.

However, climate change, lack of productivity and sustainability, wildlife encroachment, and limited supply chain contributed to slower growth.

Most of the sectors seeing credit growth, the economy saw a domestic credit swell by about Nu 13.77B in June last year from the same month the previous year. The financial institutions in the country lent a total of Nu 185.91B loans.

Bhutan being an import-dependent country, most of the credit in the country was translated to imports, shedding the country’s rupee reserve and convertible currency reserve, and hurting the current account balance (CAD).

The country’s CAD recorded an all-time high at Nu 63.4B as of June last year. At Nu 45.24B, the country’s trade deficits saw a threefold increase from June 2021.

If the credit meant for the productive sector is altered or diverted to import-related activities, the economy would be hurt.

An economist said that more than 60 percent of the sectoral loans comprise imports and consumption loans, which would not be helpful.

Besides, he said that the resources have to be channelled to productivity sectors that generate employment.

Give a Reply